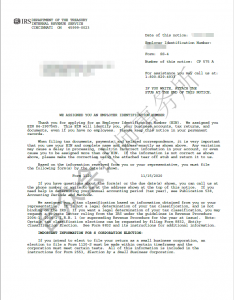

As a professional accounting firm providing corporate tax and financial services within the United States, our US Employer Identification Number (EIN) application service has the following advantages:

√ Major: Possessing North American accounting practice qualifications and high professionalism, completed by a Certified Public Accountant (CPA) in the United States throughout the entire process

√ Efficient: Certified by the US Internal Revenue Service, the company tax number can be obtained within 1-2 working days, which is efficient and convenient

√ Security: Strictly implement customer information confidentiality system, respect customer privacy rights, and absolutely protect customer rights and interests